Eglin FCU Fixed Conventional Loans offer more than just a competitive rate and great service.

Eglin FCU Fixed Conventional Loans offer more than just a competitive rate and great service. Although we charge normal closing costs we do not charge origination, pre-payment penalty, underwriting, processing, tax service, document preparation or administrative fees. These fees could really add up and avoiding them could save you several thousand dollars on your next home purchase. The choice is easy. To apply, contact our Mortgage Services team today at 850.862.0111 x.3737 or via secure email.

There are several things you will want to have ready before you begin the application process.

Before you begin the application process, we recommend you click and read the links below. "What to Expect" explains our loan process from beginning to end and the "Loan Checklist" outlines exactly what paperwork and other documentation you will need to move forward. When you're ready to apply, contact us at 850.862.0111 x.3737 or via secure email.

what to expect loan checklist

Use our fixed conventional loan payment calculator to determine how much you can afford.

| Type of Fee | EFCU | Other Lenders |

| Origination | $0 | up to 1%1 |

| Pre-payment penalty | $0 | varies by lender |

| Underwriting | $0 | up to $8951 |

| Processing | $0 | up to $4951 |

| Tax service | $0 | up to $851 |

| Document preparation | $0 | up to $1501 |

| Administrative | $0 | up to $1501 |

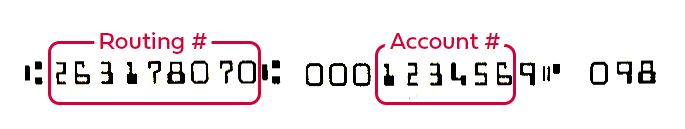

Routing Number: 263178070 *APR = Annual Percentage Rate.

©2025 Eglin Federal Credit Union. Eglin Federal Credit Union is Federally Insured by NCUA. Equal Housing Lender (NMLS 440642). Equal Opportunity Employer. Information submitted to Eglin FCU via email is not encrypted and may not be secure. Links to other sites are provided as a convenience to our visitors. The Credit Union is not responsible for the availability, content, or privacy practices of any linked site. Images used for representational purposes only; do not imply government endorsement. If you experience any problems accessing our website or using online services, please call 800.367.6159 during our normal business hours (Monday-Friday 9am-5pm CST, excluding federal holidays).

When you receive a collateral loan from Eglin FCU you'll need to agree to maintain adequate insurance coverage.

|

Alfa Romeo Maserati Pensacola |

|

Allen Turner Chevrolet |

|

Allen Turner Genesis |

|

Allen Turner Hyundai |

|

Anderson Subaru |

|

Audi Pensacola |

|

Bay Chrysler Dodge Jeep RAM |

|

Bay Lincoln |

|

Bay Mitsubishi |

|

BMW of Fort Walton Beach |

|

Buick GMC Fort Walton Beach |

|

Centennial Imports |

|

Chrysler Dodge Jeep Ram Crestview |

|

Chrysler Dodge Jeep Ram Fort Walton Beach |

|

David Scott Lee Buick GMC |

|

David Scott Lee Ft. Walton Beach |

|

First Choice Automotive |

|

Ford Crestview |

|

Ft. Walton Mitsubishi |

|

FWB Auto Brokers |

|

Gary Smith Ford |

|

Gary Smith Honda |

|

Hampton Hyundai Genesis Imports |

|

Hill Kelly Dodge |

|

Kia Fort Walton Beach |

|

Lee Nissan |

|

Mazda of Fort Walton Beach |

|

McKenzie Buick GMC |

|

Mercedes-Benz of Fort Walton Beach (ZT Motors) |

|

Orr Porsche of Destin |

|

Pensacola Honda |

|

Pete Moore Chevrolet |

|

Pete Moore Imports |

|

Preston Hood Chevrolet |

|

Sandy Sansing BMW Mini Cooper |

|

Sandy Sansing Chevrolet |

|

Sandy Sansing Chrysler Dodge Jeep Ram |

|

Sandy Sansing Mazda |

|

Sandy Sansing Milton Chevrolet LLC |

|

Sandy Sansing Nissan Inc. |

|

Step One Automotive BGC PN LLC |

|

Subaru Fort Walton Beach |

|

Tim Smith Acura |

|

Toyota of Fort Walton Beach |

|

Volkswagen Fort Walton Beach |

|

World Ford Pensacola |

Questions? Call 850.862.0111 option 2 or email Consumer Loans via secure email.

| Vehicle type | Term | APR* (as low as) |

| New or Used Up to 15 Years Old | 66 Months | 5.99% |

| New or Used Up to 10 Years Old | 74 Months | 6.49% |

| New or Used Up to 10 Years Old ($20k +) | 84 Months | 7.49% |

* APR = Annual Percentage Rate. There is a range of rates for each loan type. The rate received will be determined by an evaluation of the applicant's credit. The above rates are current as of Saturday, July 5, 2025 and are subject to change

A New Auto is one that has never been titled. A Used Auto is one that has previously been titled.

Questions? Call 850.862.0111 option 2 or email Consumer Loans via secure email.

| Loan value | Loan term | APR*(as low as) |

| Up to $10,000 | 60 Months | 6.75% |

| Up to $25,000 | 120 Months | 7.75% |

| Up to $50,000 | 144 Months | 8.00% |

| Over $50,000 | 180 Months | 8.00% |

| Loan value | Loan term | APR*(as low as) |

| Up to $10,000 | 60 Months | 7.75% |

| Up to $25,000 | 120 Months | 8.75% |

| Up to $50,000 | 144 Months | 9.00% |

| Over $50,000 | 180 Months | 9.00% |

Questions? Call 850.862.0111 option 2 or email Consumer Loans via secure email.

| Loan value | Loan term | APR*(as low as) |

| Up to $10,000 | 60 Months | 6.75% |

| Over $10,000 | 120 Months | 7.75% |

| Over $25,000 | 144 Months | 8.00% |

| Over $50,000 | 180 Months | 8.00% |

| LOAN VALUE | LOAN TERM | APR*(as low as) |

| Up to $10,000 | 60 Months | 7.75% |

| Over $10,000 | 120 Months | 8.75% |

| Over $25,000 | 144 Months | 9.00% |

| Over $50,000 | 180 Months | 9.00% |

| Loan value | Loan term | APR*(as low as) |

| Up to $10,000 | 60 Months | 6.00% |

| Over $10,000 | 72 Months | 7.75% |

| Over $20,000 | 84 Months | 8.25% |

Questions? Call 850.862.0111 option 2 or email Consumer Loans via secure email.

| Loan value | Loan term | APR*(as low as) |

| Up to $10,0001 | 48 Months | 7.00% |

| Over $10,0002 | 60 Months | 7.00% |

| Loan term (up to) | APR*(as low as) |

| 60 Months | 6.00% |

Questions?

Contact our Mortgage Services team today at 850.862.0111 x.3737 or via secure email

| LOAN TERM | APR* | ORIGINATION FEE | POINTS |

| 30 year | 6.500% | 0% | 0 |

| 20 year | 5.875% | 0% | 0 |

| 15 year | 5.500% | 0% | 0 |

Questions?

Contact our Mortgage Services team today at 850.862.0111 x.3737 or via secure email

| LOAN TERM | APR* | ORIGINATION FEE | POINTS |

| 30 year | 6.500% | 0% | 0 |

| 20 year | 5.875% | 0% | 0 |

| 15 year | 5.500% | 0% | 0 |

Questions?

Contact our Mortgage Services team today at 850.862.0111 x.3737 or via secure email

| LOAN TERM | APR* | ORIGINATION FEE | POINTS |

| 30 year | 6.500% | 0% | 0 |

| 20 year | 5.875% | 0% | 0 |

| 15 year | 5.500% | 0% | 0 |

Questions?

Contact our Mortgage Services team today at 850.862.0111 x.3737 or via secure email

| INTEREST RATE | MAXIMUM COMBINED LTV** (TLTV) |

| 6.50% APR* | 80% |

| Interest Rate | Minimum Advance | Closing Costs |

| 7.50% APR* | $5,000** | NONE** |

*APR = Annual Percentage Rate. The APR is variable and is based on the Wall Street Journal U.S. Prime Rate which was 7.50% as of 12/19/2024. The maximum APR will not exceed 18% and the minimum APR will not be reduced below 3% at any time during the term of the plan.

**If you chose to participate in our current Home Equity Line-of-Credit Plan Promotion, Eglin FCU will pay closing costs for bona-fide third party fees (except for an appraisal or costs associated with a purchase/deed) up to $3,000. Member agrees to reimburse Eglin Federal Credit Union for the bona-fide third party fees paid if the Plan is closed within 36-months of the loan origination date. A minimum advance of $5,000 will be required at closing with this promotion.

Maximum Loan Amounts & Restrictions - Home Equity Line of Credit

Questions?

Contact our Mortgage Services team today at 850.862.0111 x.3737 or via secure email

| MAX TERM | APR* |

| 5 years | 8.50% |

| 10 years | 9.00% |

Questions?

Contact our Mortgage Services team today at 850.862.0111 x.3737 or via secure email

| MAX TERM | APR* |

|---|---|

| 9 months | 5.50% |

| LOAN TERM | APR* as low as | MAX LOAN AMOUNT |

| 42 Months | 8.90% | $20,000 |

| LOAN TERM | APR* as low as | MAX LOAN AMOUNT |

| ------ | 8.90% | $20,000 |

| REPAYMENT PERIOD | APR* | MAX LOAN AMOUNT |

| 120 days | 16.9% | $500 |

| REPAYMENT PERIOD | APR* as low as | MAX LOAN AMOUNT |

| 42 Months | 13.90% | $3000 |

| REPAYMENT PERIOD | APR* as low as | MAX LOAN AMOUNT |

| 42 Months | 5.00% | $2000 |

| LOAN TYPE | MAX LOAN AMOUNT | REPAYMENT PERIOD | APR* |

| Share Loan Pledging S1 or S4 | Available balance in account pledged | 84 months | 2.00% |

| Share Loan Pledging S7 | Available balance in account pledged | 84 months | 2.5% |

| Share Certificate Loan | Available balance of Share Certificate | Paid at maturity of Share Certificate | 3% above Share Certificate Rate |

| PREMIUM CHECKING | DIVIDEND RATE | APY* |

| A $500 minimum balance is required to earn dividends. The APY stated is accurate as of the last dividend declaration date, which is the last day of the previous quarter. Dividend rate and APY are variable and subject to change after the account is opened. If you close your account before dividends are paid you will not receive the accrued dividends. | 0.05% | 0.05% |

| REGULAR SHARE SAVINGS | DIVIDEND RATE | APY* |

| A $50 daily minimum balance is required to earn dividends. The APY stated is accurate as of the last dividend declaration date, which is the last day of the previous quarter. Dividend rate and APY are variable and subject to change after the account is opened. If you close your account before dividends are paid you will not receive the accrued dividends. | 0.35% | 0.35% |

| FL UNIFORM TRANSFER TO MINORS SAVINGS | DIVIDEND RATE | APY* |

| A $50 daily minimum balance is required to earn dividends. The APY stated is accurate as of the last dividend declaration date, which is the last day of the previous quarter. Dividend rate and APY are variable and subject to change after the account is opened. If you close your account before dividends are paid you will not receive the accrued dividends. | 0.35% | 0.35% |

| CHRISTMAS CLUB SAVINGS | DIVIDEND RATE | APY* |

| A $50 daily minimum balance is required to earn dividends. The APY stated is accurate as of the last dividend declaration date, which is the last day of the previous quarter. Dividend rate and APY are variable and subject to change after the account is opened. If you close your account before dividends are paid you will not receive the accrued dividends. | 0.35% | 0.35% |

| VIP SAVINGS | DIVIDEND RATE | APY* |

| A $50 daily minimum balance is required to earn dividends. The APY stated is accurate as of the last dividend declaration date, which is the last day of the previous quarter. Dividend rate and APY are variable and subject to change after the account is opened. If you close your account before dividends are paid you will not receive the accrued dividends. | 0.35% | 0.35% |

The Current APY and Dividend Rates shown are the current weekly rates in effect from 7/4/2025 - 7/10/2025. The Previous APY and Dividend Rate stated are accurate as of the last dividend declaration date, which is the last day of the previous month. Dividend rate and APY are variable and subject to change after the account is opened. If you close your account before dividends are paid you will not receive the accrued dividends.

|

Money Market Balance |

Current Dividend Rate |

Current APY* |

Previous Dividend Rate |

Previous APY* |

| $.00 to 2,499.99 | 0.05% | 0.05% | 0.05% | 0.05% |

| $2,500.00 to 9,999.99 | 0.95% | 0.95% | 0.95% | 0.95% |

| $10,000.00 to 24,999.99 | 1.00% | 1.01% | 1.00% | 1.01% |

| $25,000.00 to 49,999.99 | 1.05% | 1.06% | 1.05% | 1.06% |

| $50,000.00 & up | 1.10% | 1.11% | 1.10% | 1.11% |

| COVERDELL EDUCATION SAVINGS | DIVIDEND RATE | APY* |

| A $50 daily minimum balance is required to earn dividends. The APY stated is accurate as of the last dividend declaration date, which is the last day of the previous quarter. Dividend rate and APY are variable and subject to change after the account is opened. If you close your account before dividends are paid you will not receive the accrued dividends. | 0.35% | 0.35% |

A $50 daily minimum balance is required to earn dividends. All Current APY and Dividend Rates shown are the current weekly rates in effect on 7/4/2025. Dividend rate and APY are variable and subject to change after the account is opened. The Previous APY and Dividend Rates stated are accurate as of the last dividend declaration date, which is the last day of the previous quarter.

| Account Description | Current Dividend Rate | Current APY* | Previous Dividend Rate | Previous APY* |

| Traditional IRA | 3.85% | 3.92% | 3.95% | 4.03% |

A $50 daily minimum balance is required to earn dividends. All Current APY and Dividend Rates shown are the current weekly rates in effect on 7/4/2025. Dividend rate and APY are variable and subject to change after the account is opened. The Previous APY and Dividend Rates stated are accurate as of the last dividend declaration date, which is the last day of the previous quarter.

| Account Description | Current Dividend Rate | Current APY* | Previous Dividend Rate | Previous APY* |

| Roth IRA | 3.85% | 3.92% | 3.95% | 4.03% |

A $2500.00 minimum deposit required. There is a penalty for early withdrawal.

Rates listed are current from 7/4/2025 - 7/10/2025.| CERTIFICATE TYPE | DIVIDEND RATE | APY* |

| 31 Days / 1 month Certificate | 3.50% | 3.56% |

| 92 days / 3 month Certificate | 3.50% | 3.56% |

| 182 days / 6 month Certificate | 3.80% | 3.87% |

| 365 days / 12 month Certificate | 3.90% | 3.97% |

| 548 days / 18 month Certificate | 3.95% | 4.02% |

| 730 days / 24 month Certificate | 3.85% | 3.92% |

| 1095 days / 36 month Certificate | 3.75% | 3.82% |

| 1460 days / 48 month Certificate | 3.70% | 3.76% |

| 1825 days / 60 month Certificate | 3.65% | 3.71% |

| Annual Percentage Rate (APR) for Purchases, Balance Transfers, and Cash Advances | as low as 7.9% up to 14.9% The APR is determined at account opening and is based on the borrower's credit score. |

| Penalty APR | None |

| Paying Interest | Your due date is at least 24 days after the close of each billing cycle. We will not charge you interest on purchases if you pay your entire balance by the due date each month. We will begin charging interest on cash advances and balance transfers on the transaction date |

| Minimum Interest Charge | None |

| For Credit Card Tips from the Consumer Financial Protection Bureau | To learn more about factors to consider when applying for or using a credit card, visit the website of the Consumer Financial Protection Bureau at http://www.consumerfinance.gov/learnmore |

| Annual Fee | None |

| Transaction Fees | |

| Balance Transfer | None |

| Cash Advance | None |

| International Transaction | None |

| Penalty Fees | |

| Late Payment | $20 or the amount of the required minimum payment, whichever is less, if you are 12 or more days late in making a payment. |

| Over-the-Credit-Limit | None |

| Returned Payment | Up to $28.00 |

| Annual Percentage Rate (APR) for Purchases, Balance Transfers, and Cash Advances | as low as 8.9% up to 15.9% The APR is determined at account opening and is based on the borrower's credit score. |

| Penalty APR | None |

| Paying Interest | Your due date is at least 24 days after the close of each billing cycle. We will not charge you interest on purchases if you pay your entire balance by the due date each month. We will begin charging interest on cash advances and balance transfers on the transaction date |

| Minimum Interest Charge | None |

| For Credit Card Tips from the Consumer Financial Protection Bureau | To learn more about factors to consider when applying for or using a credit card, visit the website of the Consumer Financial Protection Bureau at http://www.consumerfinance.gov/learnmore |

| Annual Fee | None |

| Transaction Fees | |

| Balance Transfer | None |

| Cash Advance | None |

| International Transaction | None |

| Penalty Fees | |

| Late Payment | $20 or the amount of the required minimum payment, whichever is less, if you are 12 or more days late in making a payment. |

| Over-the-Credit-Limit | None |

| Returned Payment | Up to $28.00 |

When you received your loan you agreed to maintain adequate insurance coverage. If your insurance information has changed or you receive a letter stating we do not have proper documentation, you should provide us with a copy of your insurance declarations page (not your insurance card). The declarations page must show the following information:

Eglin Federal Credit Union uses small text files called cookies to collect anonymous Web site traffic data. This information helps improve our Web services. Our cookies do not collect or store any personally identifiable information.

To help fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens or signs on an account.

When you open an account, we will ask you for your name, physical address, date of birth and other information that will allow us to identify you.

Please refer to the following guidelines for providing your account number:

In compliance with The Secure and Fair Enforcement for Mortgage Licensing Act, also known as the SAFE Act, we provide a list of Eglin FCU's registered mortgage loan originators and their Nationwide Mortgage Licensing System (NMLS) number on our website. The SAFE Act was passed to ensure the integrity of the Mortgage Lending system by establishing a set of standards that specific mortgage professionals must meet in order to work in the mortgage industry.

| Eglin FCU Mortgage Professional | NMLS ID |

| Aimee N Wilson | 2536346 |

| Ann Creager | 1561554 |

| Ashley Lynn Ellis | 2701133 |

| Ashley Hall | 1011145 |

| Brian Mark Franks | 1296056 |

| Carole Stanley | 1482257 |

| Carrie Ann Calcutt | 2064000 |

| Christina Walker | 1714720 |

| Christy Milian | 490970 |

| Cynthia Bower | 2064007 |

| Elisabeth Diana Good | 2664398 |

| Jaime Lynn O'Callaghan | 2697800 |

| Jennifer Leigh Wyatt | 2329051 |

| Jesus Abad Morales Ramos | 2675473 |

| John Pellerin | 1011113 |

| John Francis Stackpoole | 2398303 |

| Judith Anne Turner | 2311448 |

| Kayla Michelle Smith | 2177769 |

| Lilly B. Edra | 2041564 |

| Lisa Diane Freeland | 2367009 |

| Mary Ann Geoghagan | 2329070 |

| Michelle (Beth) Bethanne Meverden | 2460346 |

| Michele (Shellie) Marie Fite | 798447 |

| Mindy Danielle Dumas | 2496680 |

| NormaJean Enlow | 1212774 |

| Rebecca Jean Snow | 2484799 |

| Ruby Tincher | 1212771 |

| Samara Genine Simeone | 2672002 |

| Sheeny Marquez Satulan | 2237420 |

| Susan Castillo Dombrigues | 490967 |

| Tatyana Galenkova | 2063947 |

| Teally Goodson Gorey | 2421096 |

| Tiffany Michelle Cadogan | 1867034 |

| Yolanda Harrison | 805809 |

| Zena Payne | 490969 |

| Eglin FCU | 440642 |

eStatements provide online access to your account statements instead of by mail. Besides being an excellent way to help our environment, going paperless is also a fast, convenient and safe way to view your monthly statement. This service is free to all Eglin FCU members and can be cancelled at any time. To receive eStatements, Online Banking is required.

Set up eStatements today by logging in and selecting 'eStatements' under the 'eServices' tab in the main navigation.

We recommend that members with Online Banking log in to make these changes in the "Contact Information" section under the "My Profile" tab.

Please note: For the safety and security of our members, some services may be limited for up to 30 days after an address change. Print the Change of Contact Information form to submit it in person at an Eglin FCU branch.

Complete the skip-a-pay form to agree to the terms* and request your preference to skip your next loan payment on your Eglin FCU loan product. Please note: It may take up to 2 business days to process your request. If submitted via DocuSign, you will receive a confirmation email when your request has been processed. If you have questions or need additional assistance, please call 850.862.0111 or 800.367.6159.

*Subject to approval. Your account must be in good standing. This offer is subject to a $20 processing fee for each loan payment skipped. Only one skip allowed per loan per calendar year. This offer excludes Mastercard®, S.A.F.E. Loans, Share Certificate Loans, Mortgage Loans, and Mobile Home Loans. Loan must be at least one year old. Skipping a payment will extend the repayment period on the loan and interest continues to accrue during the skip period. Except as expressly amended by this agreement the terms of the original loan agreement remain in full force and effect. Annual Percentage Rate and scheduled payment do not change. GAP protection coverage will be reduced if you skip or miss more than 2 monthly payments over the life of the loan.

| Holiday | Date |

| Name | Title |

| Cathie Staton | President/Chief Executive Officer |

| Gina Denny | SVP/Chief Human Resources Officer |

| Tim Farnsworth | SVP/Chief Technology Officer |

| C. Grant | SVP/Chief Financial Officer |

| Rocky Magee | SVP/Chief Information Officer |

| Kim Nauta | SVP/Chief Operations Officer |

| Dawn Oravetz | SVP/Chief Payments Officer |

| Jon Heidt | SVP Risk Management |

| Neko Stubblefield | SVP Membership/Community Development |

| Joe Baldwin | VP Investments |

| Laura Coale | VP Marketing/PR |

| Ashley Hall | VP Mortgage Services |

| David Lancaster | VP Lending |

| Bron Ringstad | VP Branch Operations |

| Name | Title |

| Daniel McInnis | Chair |

| William S. Rone | Vice Chair |

| James Pitts | Secretary/Treasurer |

| Richard Adams | Director |

| Robert Harlan | Director |

| Barbara Patty | Director |

| J. Russ Corbitt | Director |