Check out the easy-to-use Credit Score Simulator, powered by SavvyMoney, which takes the guesswork out of managing your credit. It takes the "what-ifs" and generates an approximate credit score to help you see where you stand.

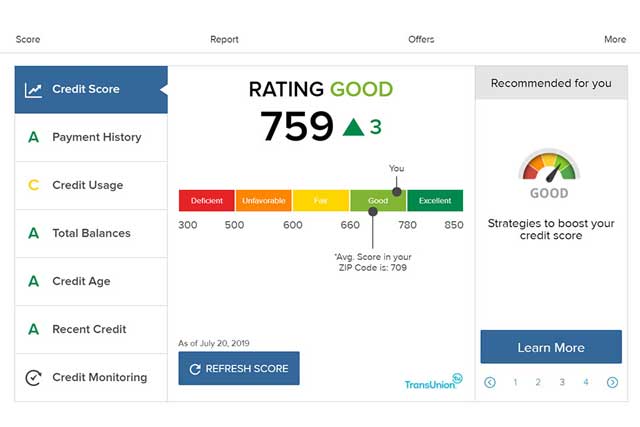

If you are an Online Banking user, you can log in to your Eglin FCU account, and click on the "Track my Score" button to have access to your credit report as often as you like without impacting your credit score. In the Mobile App, you can find it under the "view your free credit score & report" button. This service is FREE.

Now available when logged into your account online via a browser or the Eglin FCU Mobile App. Click the banner in Online Banking or the Mobile App and agree to the terms to access this new and exciting feature.

It is important to understand the value of monitoring your credit information regularly as your credit score has a major impact on the Annual Percentage Rate you qualify for on auto loans, credit cards, mortgages and more. We've made this easier than ever by providing 24/7 access to your free, comprehensive credit report when logged into your account online via a browser or the app. Your free credit report makes checking and monitoring your credit both easy and efficient without affecting your score.

Your Comprehensive Credit Report Features

-

Unlimited access to your credit score and key factors impacting your score. View your credit score as often as you like and identify how inquiries, payment history and other factors influence this number.

-

Credit alerts. Receive email notifications of significant changes to your credit file (e.g., hard inquiries, new account openings, change of address) as well as any activities suspect to fraud or identity theft.

-

Credit improving tips. Gain insight on actions that may be helping or harming your credit score.

-

Money-saving opportunities with various Eglin FCU products. Receive instant offers right on your dashboard and discover how refinancing with Eglin FCU can save you money and/or reduce your payments.

-

Credit score history. Observe how your credit score has changed over time.

-

Average credit score within your ZIP code. View the average credit score in your area and see how you compare.

-

Initiate credit disputes. Send a dispute at the click of a button if you notice any incorrect information.

Why Credit Monitoring Matters

-

Know the interest rates you qualify for on loans. Your credit score determines your ability to qualify for loans and receive better interest rates when borrowing. Knowing your credit score can help you shop for the best APR before applying for the loan.

-

Ensure your credit information is accurate. Your credit score is directly linked with the information in your credit report and can give you an indication as to whether your credit information is accurate. If your credit score is lower than you expect, it may point to some errors that need to be disputed with the credit bureaus.

-

Deter fraud and identity theft early. With technology increasing rapidly and fraudsters and identity thieves becoming more creative, monitoring your credit report on a regular basis is more critical than ever. Your comprehensive credit report will alert you as soon as suspicious activity appears on your account so you will be able to stop fraud and identity theft in its tracks.

-

Stay updated on ways to improve your score. Items such as short credit histories, high balances on credit cards, and late payments can all affect your score. Your comprehensive credit report will note which of these are impacting your credit score so you can develop a plan for strengthening it.

-

Enjoy financial peace of mind. The convenience of your credit score, credit report and instant offers at Eglin FCU right on your dashboard will help you take control of your credit and gain the upper hand on your finances.

Difference in Credit Scores

If you have ever received your credit score from the three major credit bureaus, you may have noticed that these scores are not the same. Why do credit scores vary? Here is why.

Scoring Models

Differences in credit scores derive from the numerous credit scoring models that are used in the financial industry. Credit scoring models are used by credit bureaus to collect and analyze your statistical data to determine your credit eligibility. There are a range of credit scoring models that weigh in on varying factors which change the way scores are computed, however, Eglin FCU uses the FICO 9 scoring model and the VantageScore model.

FICO Scoring Model

The FICO Scoring model has been around since 1989 and is the most widely used measure of creditworthiness primarily due to its longevity. FICO scores take payment history, credit utilization, credit history, types of credit, and new credit into account when determining its credit score, with much emphasis or "weight" placed on payment history and credit utilization. Eglin FCU has upgraded to VantageScore Model which is the score used for all Eglin FCU loan decisions.

VantageScore Model

The VantageScore model was created by the three major credit bureaus (Experian, Equifax, and Transunion) in 2006. The VantageScore model takes payment history, age and type of credit, credit utilization, total balances, recent behavior, and available credit into account when determining its credit score, with much emphasis or "weight" placed on payment history, age and type of credit, and credit utilization. Your free credit score uses the VantageScore model.

If you have any further questions regarding your comprehensive credit report, contact us at 850.862.0111 x.1421.

Tap the gear icon in the appropriate section on the "Accounts" page of the mobile app to access the "Edit Accounts" page. From there, tap the pencil icon next to the account you wish to adjust. You will be presented with options to nickname that account, hide it (or unhide it) and set your "Primary Transfer From" preference. Please note that toggling on the "Hide in the List" switch on an account will not only hide it from the list on the "Accounts" page, but also hide it from every other aspect of the app, including the "From" and "To" fields while initiating or setting up a transfer.

Tap the gear icon in the appropriate section on the "Accounts" page of the mobile app to access the "Edit Accounts" page. From there, tap the pencil icon next to the account you wish to adjust. You will be presented with options to nickname that account, hide it (or unhide it) and set your "Primary Transfer From" preference. Please note that toggling on the "Hide in the List" switch on an account will not only hide it from the list on the "Accounts" page, but also hide it from every other aspect of the app, including the "From" and "To" fields while initiating or setting up a transfer.

Tap the gear icon in the appropriate section on the "Accounts" page of the mobile app to access the "Edit Accounts" page. From there, tap the pencil icon next to the account you wish to adjust. You will be presented with options to nickname that account, hide it (or unhide it) and set your "Primary Transfer From" preference.

Tap the gear icon in the appropriate section on the "Accounts" page of the mobile app to access the "Edit Accounts" page. From there, tap the pencil icon next to the account you wish to adjust. You will be presented with options to nickname that account, hide it (or unhide it) and set your "Primary Transfer From" preference.

To access the rewards site (Dreampoints), first select your Rewards Mastercard from the Accounts page, this will take you to the transaction history page for your credit card. From there, select the gear icon in the top right corner of the card tile at the top of the page. A "Card Rewards" button will be displayed on that page, simply tap it to be redirected and automatically signed into the Dreampoints rewards site.

To access the rewards site (Dreampoints), first select your Rewards Mastercard from the Accounts page, this will take you to the transaction history page for your credit card. From there, select the gear icon in the top right corner of the card tile at the top of the page. A "Card Rewards" button will be displayed on that page, simply tap it to be redirected and automatically signed into the Dreampoints rewards site.

To access CardControls, tap the "Services" menu item in the main navigation at the bottom of the screen. On the "Services" page is a button labeled "CardControls." Tapping the CardControls button will automatically open and sign you into the CardControls app. If you do not have the CardControls app installed on your device you will instead be taken to the app store to download and install. Once the CardControls app is installed, follow the previous instructions to gain access.

To access CardControls, tap the "Services" menu item in the main navigation at the bottom of the screen. On the "Services" page is a button labeled "CardControls." Tapping the CardControls button will automatically open and sign you into the CardControls app. If you do not have the CardControls app installed on your device you will instead be taken to the app store to download and install. Once the CardControls app is installed, follow the previous instructions to gain access.

To opt in and out of Courtesy Pay for Debit POS Transactions, tap the profile icon located in the top right corner of the mobile app. Once on your profile page you will see a button labeled Courtesy Pay for Debit POS Transactions listed at the top. Tap that button to open the Courtesy Pay for Debit POS Transactions page where a list of eligible accounts is displayed along with a toggle for each. To opt in or out, toggle the switch and tap "Save." If you are opting into Courtesy Pay for Debit POS transactions you will be presented with the Courtesy Pay for Debit POS Transactions disclosure and agreement, you must agree to this for your opt-in request to be fulfilled.

To opt in and out of Courtesy Pay for Debit POS Transactions, tap the profile icon located in the top right corner of the mobile app. Once on your profile page you will see a button labeled Courtesy Pay for Debit POS Transactions listed at the top. Tap that button to open the Courtesy Pay for Debit POS Transactions page where a list of eligible accounts is displayed along with a toggle for each. To opt in or out, toggle the switch and tap "Save." If you are opting into Courtesy Pay for Debit POS transactions you will be presented with the Courtesy Pay for Debit POS Transactions disclosure and agreement, you must agree to this for your opt-in request to be fulfilled.

To update your contact information, select the profile icon in the top right corner of the mobile app. This will take you to the Profile page where you can update your phone numbers, email and address on system. You can also make adjustments to your security settings such as your username and password as well as alerts and two-factor authentication preferences on this page.

To update your contact information, select the profile icon in the top right corner of the mobile app. This will take you to the Profile page where you can update your phone numbers, email and address on system. You can also make adjustments to your security settings such as your username and password as well as alerts and two-factor authentication preferences on this page.

There are two views to choose from that change the functionality of the account selection mechanism on the Transfers page. Tap the icon in the top right corner of the transfers page to toggle between these two views. The "list" view allows you to select your sending and receiving accounts by tapping them to present a list of available accounts while the "card" view allows you to swipe right and left to scroll through your available accounts.

There are two views to choose from that change the functionality of the account selection mechanism on the Transfers page. Tap the icon in the top right corner of the transfers page to toggle between these two views. The "list" view allows you to select your sending and receiving accounts by tapping them to present a list of available accounts while the "card" view allows you to swipe right and left to scroll through your available accounts.